Recent Articles

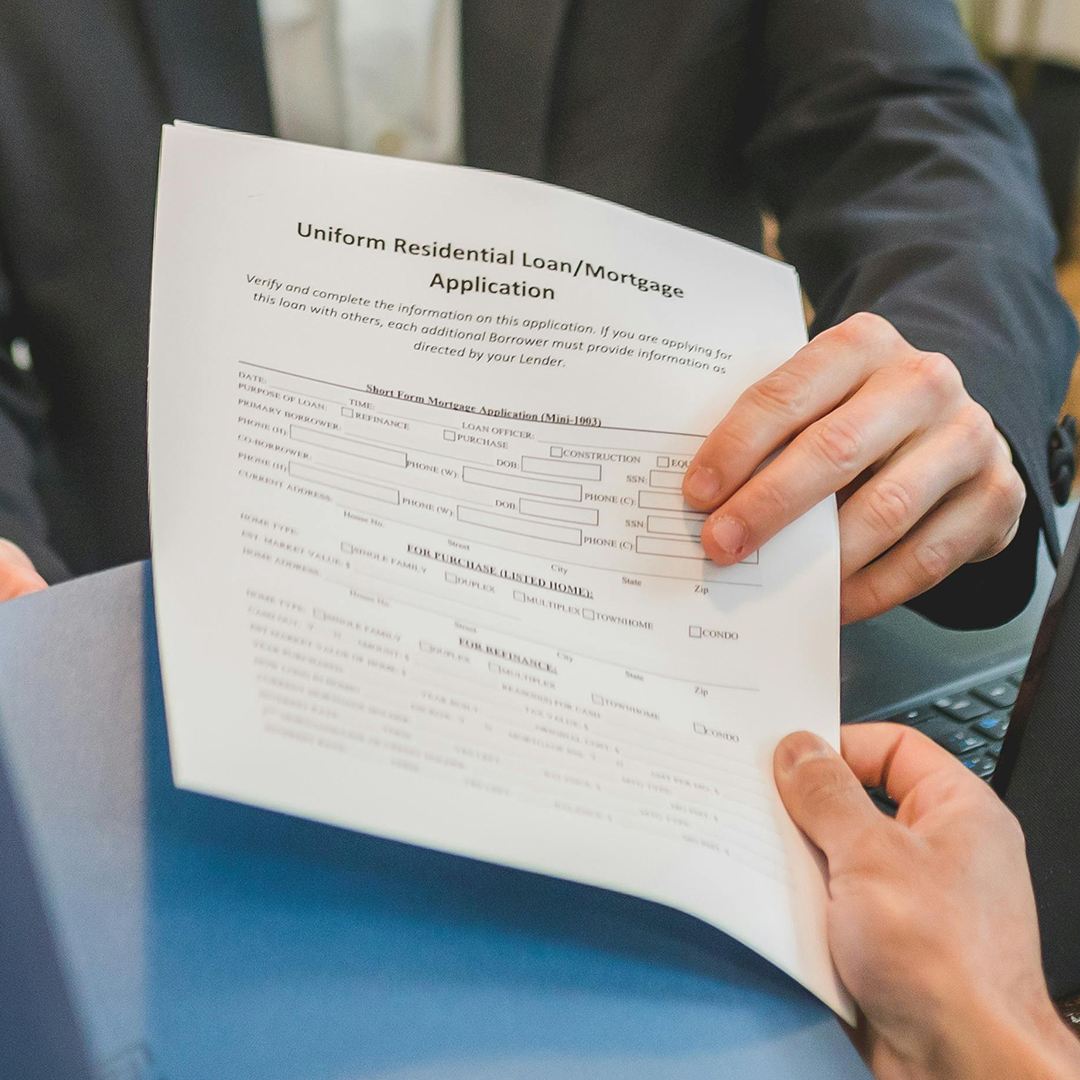

5 Mistakes Self-Employed Buyers Make When Applying for a Mortgage

Self-employed in Texas? Avoid these 5 common mortgage mistakes that can delay or derail your home purchase and learn how to get approved faster.

Published on 10/29/2025

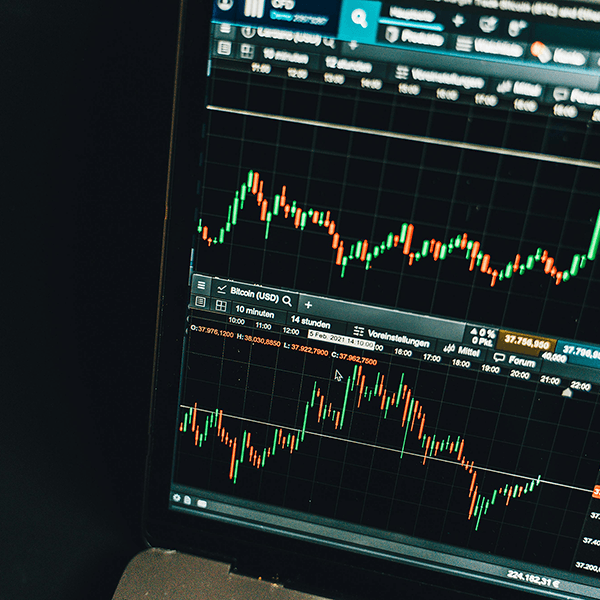

Mortgage Rates Hold Near Yearly Lows as Market Awaits Next Data

The average 30-year fixed mortgage rate is hovering near 3-year lows as bond markets hold steady amid limited economic data. Learn why rates remain low and what could move them next.

Published on 10/22/2025

Gen Z and the Dream of Homeownership: Adapting to a Challenging Market

A new Realtor.com survey reveals that 1 in 5 Gen Z adults say housing affordability is their top life concern. Learn how young buyers are adapting, saving, and staying determined to achieve homeownership.

Published on 10/15/2025

Mortgage Rates Tick Up Slightly as Bonds Weaken and MBS Underperform

On October 9, 2025, the average 30-year fixed mortgage rate edged slightly higher to 6.38% after a weaker 30-year Treasury auction and mild MBS underperformance. Rates remain stable within a narrow range as the government shutdown continues.

Published on 10/10/2025

From City Dweller to Landowner: Financing Tips for First-Time Hobby Farmers in San Antonio

From City Dweller to Landowner: Financing Tips for First-Time Hobby Farmers in San Antonio

Published on 10/02/2025

Mortgage Rates Holds Steady After Weak Jobs Report

On October 1, 2025, the average 30-year fixed mortgage rate held at 6.37% after weak private payroll data. Bigger shifts may follow when the delayed government jobs report is released.

Published on 10/01/2025

Quick Guide to Buying a Home in San Antonio Without a Social Security Number

Meta: Learn how to buy a home in San Antonio without an SSN using an ITIN loan. Steps, requirements, and guidance for local buyers.

Published on 09/29/2025

3 Reasons Home Affordability Is Improving This Fall

Affordability is finally improving this fall thanks to lower average 30-year fixed mortgage rates, slower home price growth, and rising wages. Learn why now could be the right time to buy.

Published on 09/26/2025

Mortgage Rates Hit Yearly Lows—Then Jump After the Fed Cut. Here’s What Happened (and Why Applications Just Surged)

After touching yearly lows early in the week, the average 30-year fixed rose following the Fed’s rate cut—thanks to the dot plot and Powell’s comments. Still, mortgage applications just saw their biggest weekly jump since 2021 as homeowners reacted to earlier rate declines. Here’s what it means for buyers and homeowners.

Published on 09/19/2025

Top Homebuyer Assistance Programs in San Antonio for 2025

Explore the top homebuyer assistance programs in San Antonio for 2025, including down payment help, first-time buyer grants, and HUD’s Good Neighbor Next Door.

Published on 09/15/2025

Mortgage Rates Near 11 Month Lows—What’s Next With the Fed?

The average 30-year fixed is holding near the lowest levels since October 2024 after a weak jobs report and cooler inflation. Here’s why—and what to watch at next week’s Fed meeting.

Published on 09/12/2025

Why Mortgage Rates Move: What Every Homebuyer Should Know

Mortgage rates are holding near 10-month lows—but don’t assume they’ll stay there. Learn why rates move, what drives them, and what smart buyers and homeowners should do next.

Published on 09/03/2025

Mortgage Rates Holding Steady… For Now

After Powell's Jackson Hole speech, mortgage rates hit their lowest levels since Oct 2024. But don’t get too comfortable—more movement could be coming after Friday’s inflation data and next week's jobs report.

Published on 08/27/2025

Lower Rates? Don’t Relax Just Yet

Mortgage rates stayed mostly flat this week, holding near 10-month lows. Here’s what happened from August 18–20 and why upcoming economic data could shake things up.

Published on 08/20/2025

Mortgage Rates at 10-Month Lows! Big Opportunity!

Mortgage rates are holding near 10-month lows after early August’s jobs report and mixed inflation data. Here’s what homebuyers and homeowners need to know.

Published on 08/14/2025

Rates Just Hit a 10-Month Low!

Mortgage rates just hit their lowest levels since October 2024 following a big shift in the bond market. Here’s why it matters for homebuyers and homeowners.

Published on 08/05/2025

Self-Employed but No W-2? Here’s How You Can Still Buy a Home in San Marcos

Discover why San Marcos is ideal for self-employed homebuyers and how you can secure a mortgage without traditional income documents.

Published on 08/01/2025

Housing Market Confusing? Here’s Why You’re Hearing Mixed Messages

Confused by the housing market? You're not alone. Here's why the market feels hot and cold at the same time—and what it means for you as a homebuyer.

Published on 07/30/2025

How Freelancers Can Get Pre-Approved for a Mortgage in Texas (Even Without Tax Returns)

Freelancer in Texas? Learn how to get pre-approved for a mortgage without tax returns. Explore bank statements and 1099 loan options tailored for self-employed homebuyers.

Published on 07/29/2025

5 Mistakes Self-Employed Buyers Make When Applying for a Mortgage in Texas

Self-employed in Texas? Avoid these 5 common mortgage mistakes freelancers, contractors, and entrepreneurs make when buying a home.

Published on 07/23/2025